At Just Defined Benefit (DB), we’re here to help schemes of all sizes secure the best outcome for their members.

Moving to buy-in and buy-out via a bulk purchase annuity isn’t something DB schemes experience every day. But we do. Just has guided hundreds of schemes – big, small and complex – through their de-risking journey.

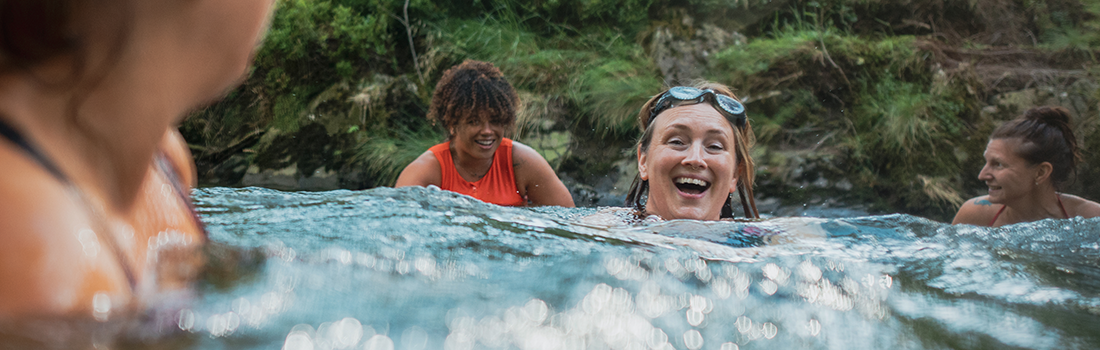

While our teams, tools, tech, agility and innovation shape our approach to a buy-in or buy-out, above all it’s about how we care. From the trustee experience in the transition process to the ongoing member experience after buy-out, we put people first.

Embarking on your de-risking journey

Every trustee wants financial security for their members. But for many years it was tough to achieve. More recently, an uncertain outlook and choppy market conditions make the future harder to predict. We can give your members the certainty they need.

As an insurer, we’ve secured member benefits for hundreds of schemes. It means we’ve dealt with all kinds of scenarios and have experts to help you. They will guide you to buy-in and through to buy-out, if it’s right for your scheme. We'll make sure the price is right, the process is smooth, and your members get the care and attention they deserve.

The stages of a bulk annuity journey are many and varied. Each scheme is unique but the general process stays the same. Below is a bird’s eye view of what’s involved.

Preparing for buy-in

Helping you get ready

While bulk annuity transactions are familiar waters to us, we understand they’re new territory for many trustees. You’ll have a lot to consider. Whether you’d like a chat or formal presentation, we can help you understand the process, answer any questions and give you guidance on how to prepare, including getting ahead on data cleansing.

We can share all the information you need to decide whether a bulk annuity transaction is right for your scheme. You can pick our brains, with no cost or obligation. We know it’s important to work collaboratively with you, your advisers, lawyers and stakeholders to achieve our common goal.

Reasons to choose us

Our story features big numbers, but we always remember there’s a person behind every policy. Hundreds of schemes have trusted us with their members’ future. We’ve completed over 400 bulk annuity transactions since we started in 2012. Today, we’re responsible for one in five de-risking transactions completed in the market.

Our streamlined process supports any scheme, no matter what their size or complexity.

An insurer financial strength rating of A+ has been given to Just Group’s principal insurance subsidiary, Just Retirement Limited, by Fitch (November 2023). Just Group’s financial investments as at 31 December 2023 were almost £24 billion. Just Group has helped over 650,000 customers achieve a better later life.

News and Views

Our People

Our Defined Benefits team have completed 400 bulk annuity transactions since we started in 2012. Whether they work in business development or asset sourcing, their goal is achieving the best possible outcome for a scheme and its members.

Everyone who works at Just cares about helping people achieve a better later life. We only recruit people who believe in our purpose and share our values.

View our peopleJust Group

We're part of Just Group, a FTSE-listed company. Just exists to help people achieve a better later life.

We provide competitive products, financial advice, guidance and services to those approaching, at and in retirement. We're trusted by our customers to invest £24 billion of their money to fulfill our promises.

View Just Group